Non-chargeability to tax in respect of offshore business activity 3 C. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Steve Ting Accounting Nf 1926 Home Facebook

Find out more.

. The relevant provisions of the Income Tax Act 1967 ITA 1967 for this Ruling are sections 7 13 subsection 833 and paragraph 15 of Schedule 6. Veerinder on Malaysian Tax Theory And Practice 5th Edition. Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status. Resignation of auditor under The Companies Act 2016. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Guide to Company Secretarial Practice in Malaysia - 5th Edition. By giving notice in writing and delivered to the registered office of the company. 31 Employer in relation to an employment means.

However foreign-sourced income of all Malaysian tax residents except for the. Income tax act 1967 revised 1971 laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6. It sets out the interpretation of the.

Appointment of auditor of a public company under The Companies Act 2016. Short title and commencement 2. A 175 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate with the business income.

Starting from Malaysia income tax Year of Assessment 2014. Malaysia MYS Aggregate to total income Relevant to TX-MYS This article covers all the deductions found under Section 44 of the Income Tax Act 1967 although detailed explanations are restricted to items examinable for TX-MYS. However certain royalty income earned by a non-resident person may be exempted from tax.

With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Such employee must serve under the same employer for a period of 12.

The words used in this Ruling have the following meaning. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Resignation takes effect after twenty-one days or from the date as may be specified in the notice.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. It sets out the interpretation of the Director General in.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. LAWS OF MALAYSIA Act 833 FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Labuan Business Activity Tax Act 1990 the Promotion of Investments Act 1986 the Finance Act 2012 and the Finance Act 2018. From one AGM to the next AGM.

Malaysia Master Tax Guide 2021 - 38th Edition. Malaysia Income Tax Act 1967 with Complete Regulations and Rules 10th Edition Find out more. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia.

Charge of income tax 3 A. Tax implications of financial arrangements for motor vehicles Relevant to TX-MYS A look at company vehicles and explains how the nature of. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars.

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. Employment and the tax treatment of compensation for loss of employment.

MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. Section 138A of the Income Tax Act 1967 ITA provides that the Director General of Inland Revenue is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. ENACTED by the Parliament of Malaysia as follows.

Such employee must receive their employment income prescribed under Section 13 of the Income Tax Act 1967. Super Profits Tax Act 1963 14 of 1963 Income-Tax Amendment Act 1963 43 of 1963 Central Boards of Revenue Act 1963 54 of 1963 Taxation Laws Extension to Union Territories Regulation 1963 Finance Act 1964 5 of 1964 Direct Taxes Amendment Act 1964 31 of 1964 Income-Tax Amendment Act 1965 1 of 1965. Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia.

This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990 LBATA.

Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Finding Identity As A Hyphenated Canadian Canadian Immigrant

Revenue Law Income Tax Time Tax Becomes Payable Yew Huoi How Associates Yha Law Firm

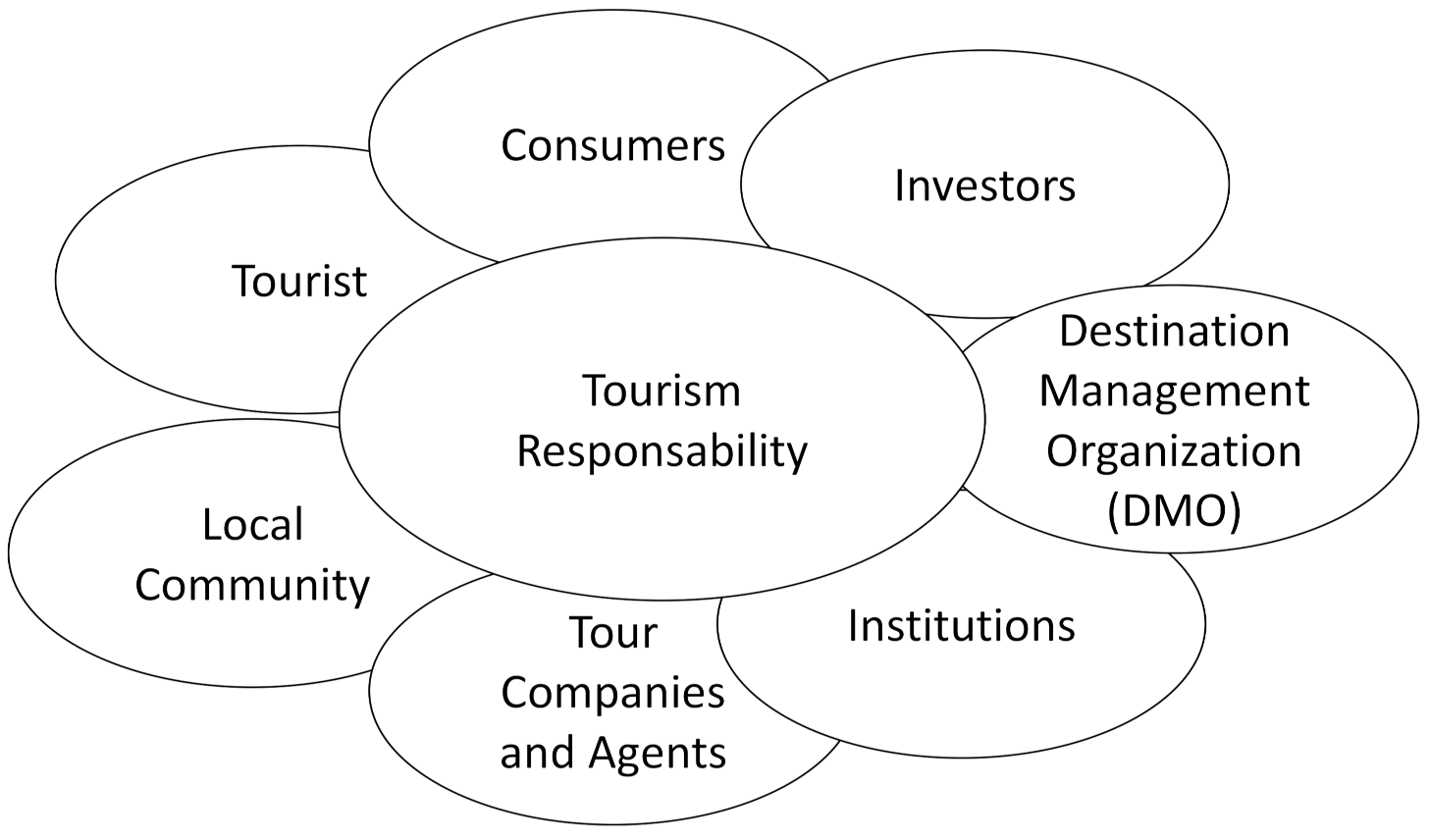

Sustainability Free Full Text A Measure Of Tourist Responsibility Html

Income Tax Act 1967 Act 53 9789678927703 Ilbs Mybuku Com

Malaysia Income Tax Conventus Law

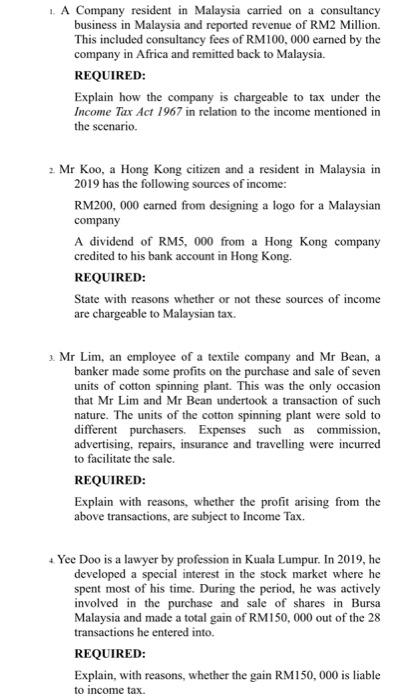

1 A Company Resident In Malaysia Carried On A Chegg Com

Post Secondary Education Canadian Immigrant

Post Secondary Education Canadian Immigrant

Tax Whiz Introduction Of Section 106a In The Income T Kpmg Malaysia

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development Happy Students

Pre Arrival Services Are Available To Help You Prepare For Your New Life In Canada Canadian Immigrant

Meet The Billionaire Family Behind The Cincinnati Bengals The Nfl S Second Least Valuable Team

The Implications Of Economic Change In Indonesia For Social Class Formation In Bijdragen Tot De Taal Land En Volkenkunde Journal Of The Humanities And Social Sciences Of Southeast Asia Volume 177 Issue 4 2021

The Tax Guidelines On Place Of Business Understanding The Rule And Its Practical Application Deloitte Malaysia Tax

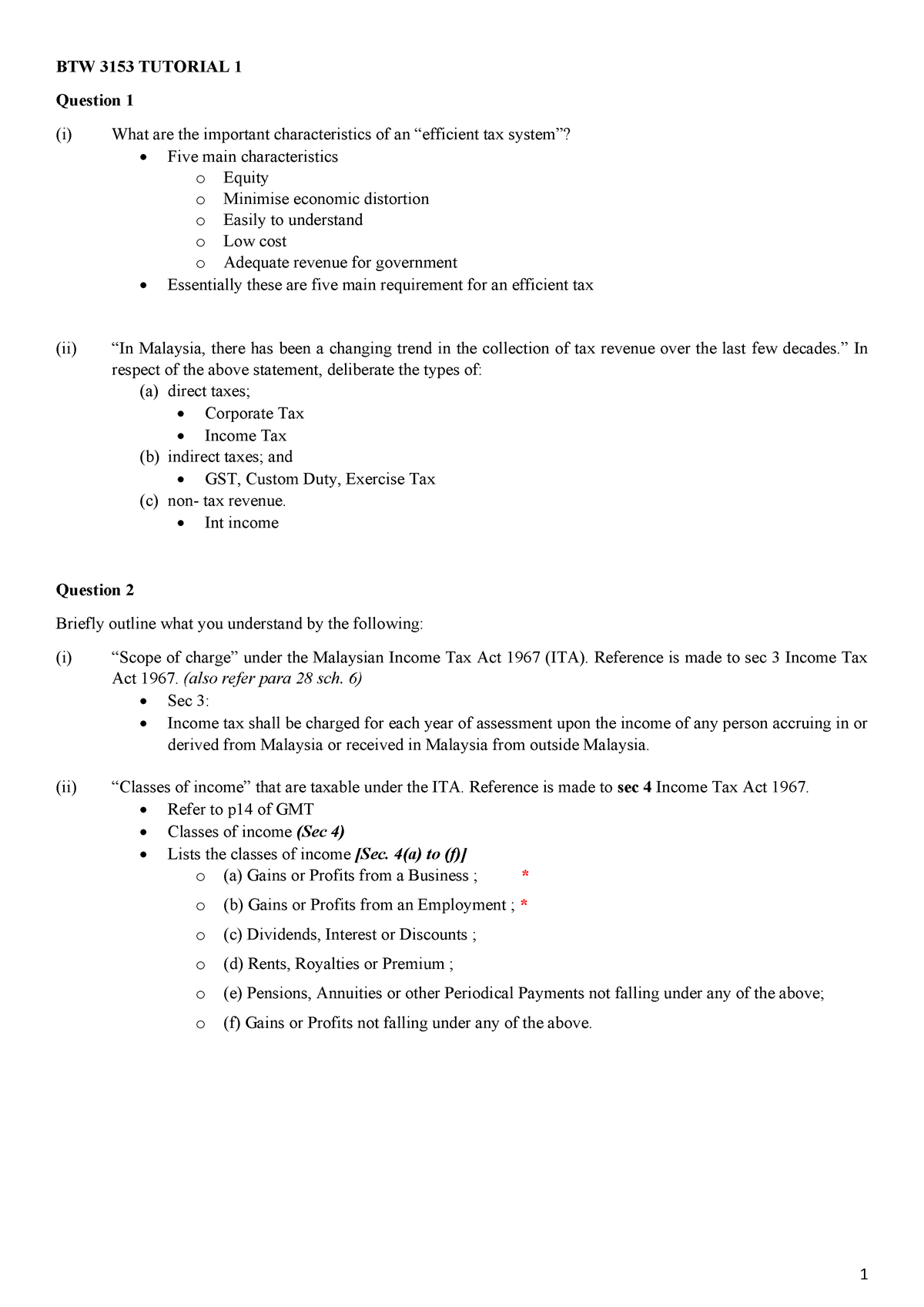

Tutorial 1 Btw 3153 Tutorial 1 Question 1 I What Are The Important Characteristics Of An Studocu

1 A Company Resident In Malaysia Carried On A Chegg Com